Considering a 2-1 Buydown? Try an ARM Instead

With the cost of homes up 10% since last year in Shenandoah County, and interest rates continuing to rise, many buyers are exploring options for reducing the compounding impact of high interest rates on already high home prices. Many are considering 2-1 buydown mortgages, where interest is prepaid, temporarily lowering your monthly payments, before returning your official interest rate after two years.

On the surface, during times of higher interest rates, getting a 2-1 Buydown mortgage might make sense—especially if you expect your income to rise in the future, as your interest rate rises. Unfortunately, with a 2-1 buydown, those high interest rates we experience today will be permanent for the remaining life of your loan after just two years. And the Federal Reserve has recently indicated that they may begin to lower the Fed Funds rate in 2024, which often means lower interest rates down the line.

A popular alternative to 2-1 temporary buydowns is the adjustable-rate mortgage (ARM). Like a temporary buydown, you will start with a lower rate for a set duration (the most popular introductory rate length is 5 years), then reset to the market rate down the line, fluctuating each year thereafter. When rates are high but are likely to fall, these mortgage products can be a smart economic choice. But when does it make sense to get an ARM over a 2-1 buydown on a conventional thirty-year loan? In this blog we will break down the differences between 2-1 buydown mortgages and ARMs and discuss advantages and disadvantages, to help you make an informed decision on which mortgage products would be the best choice for you.

What is a 2-1 buydown mortgage?

A 2-1 buydown mortgage is simply a fixed-rate mortgage where part of the interest is prepaid for the first two years, temporarily lowering monthly payments. The seller, builder, or in some cases the buyer pays to have the payment effectively reduced during this time, usually by depositing the prepayment in an escrow account. When funds for the buyback come from the seller or builder, it’s considered a ‘seller assist’.

Even if you take advantage of a 2-1 buydown mortgage, it’s important to note that everything else about the loan remains the same: your down payment amount will not change, you will need to have sufficient income to qualify for the full payment (the one that kicks in at year 3) at the time of application, and other closing costs (which average 1.74% for the buyer in the state of Virginia), will be unaffected by the buydown. And not every mortgage product can be used in conjunction with a 2-1 buydown. While conventional, 30-year fixed rate loans (‘conforming loans’) are prime candidates for a temporary buydown, if you are pursuing a nonconforming home loan product, like a VA or FHA loan, you’ll need to speak to your lender to see if it qualifies. And most lenders will only accept buydowns on fixed-rate loans—in other words, you can’t combine them with an ARM.

So, how exactly does a 2-1 buydown work?

Usually, a builder or seller uses a temporary buydown as an incentive for buyers to purchase a home, paying a lump sum into an escrow account to cover the difference in monthly payments for years one and two. Less often, a buyer with extra cash will utilize a buydown to reduce their monthly payments, though buyers often purchase ‘discount points’ for a permanent buydown (where the actual rate is reduced for the life of the loan), instead.

In the first year the monthly payment is what it would be if your mortgage rate was 2% less than the actual interest rate. In the second year, this prepayment is equal to a 1% rate reduction. In years three through the rest of the mortgage, the payment reverts to what you would pay with your actual interest rate. For example, if you have a mortgage with a 7% interest rate, in the first year your payment would be equal to a payment with a rate of 5% (i.e., 2% reduction). In the second year, it would equal that of a 6% mortgage interest rate (i.e., a 1% reduction). And in year three, your payment would rise and remain at the official 7% rate.

How does an ARM work?

With an adjustable-rate mortgage your interest is locked in at a low rate initially. Then, after a set term, it will fluctuate each year thereafter, based on market rates. While the numbers in a temporary buydown refer to the reduction of interest points in year one (2 percentage points) and year two (1 percentage point), the first number in an ARM refers to how many years your rate is locked, and the second number refers to how often it can change after that. A 3-1 ARM is locked for 3 years, but after that period it can change once per year based on market rates. Likewise, a 5-1 ARM is locked for 5 years, and a 7-1 ARM is locked for 7. The most common form of ARM is the 5-1 ARM.

When interest rates are low, an ARM might be considered a more risky mortgage product. This is because instead of locking in a low interest rate for the life of the loan, borrowers get an even lower rate for a few years, but then are at risk for large increases in monthly payments, should market rates go up. If rates go up significantly, your mortgage could become unaffordable for you. And if you choose to refinance, you’ll have to refinance at higher rates, even if you choose another ARM.

However, when interest rates are high, ARMs make a lot more sense. Not only do you lock in an initial rate that’s lower than the market rate—potentially saving you a lot of money on interest—future interest rates are less likely to increase too much over your initial rate. After the introductory period is up (or sooner!), you can also consider refinancing your loan if rates come down significantly.

Let’s take a look at a sample 5-1 ARM scenario compared to a 2-1 buydown mortgage to see how much you could save in the first five years.

Our homebuyer is interested in purchasing a house with a budget of $300,000—just shy of the recent median listing home price of $302,500 in Shenandoah County, VA. She is comparing two potential options: a 5-1 ARM at a rate of 5.5%, and a 2-1 buydown mortgage at a 6.5% interest rate. She plans on putting 20% ($60,000) down.

With a 5-1 ARM, her monthly payments would be set at $1,363 for the first five years of her loan. Total payments including interest and principal during this time would equal $81,780. After the initial five-year period, her rate will fluctuate annually based on the current market rate, or she could choose to refinance to a permanent lower rate if available.

With the 2-1 buydown mortgage, in the first year her mortgage payment would be $1,216 each month, rising to $1,363 in year two, and settling into $1,517 in the third year. Her total principal and interest payments for this five-year period would equal $85,560. Keep in mind that the ultimate higher monthly payment will continue through the life of the loan.

Benefits of a 5-1 ARM over a 2-1 Buydown Mortgage

In addition to saving money on overall loan interest and loan payments, 5-1 ARMs can have other advantages over temporary buydowns. Here are a few ways you can benefit from utilizing a 5-1 (or other) ARM:

- Reduced monthly payments for a longer term. As we mentioned above, the biggest benefit of a 5-1 ARM is that you will receive a reduced interest rate for a full five years (60 months), before your mortgage sets to the current market rate. With a 2-1 buydown, your rate climbs after the first year, before hitting the full interest rate at year 2.

- Greater stability in the near term. While ARMs will fluctuate more often after the first five years than a 2-1 buydown, in those first five years of your loan your rate and monthly payment won’t change. As you are recouping the savings you put toward your down payment, closing, and moving costs, not having to worry about rising rates within the first year can be helpful to buyers—especially those who are just starting out.

- More money for other expenses. The first few years are when homeowners typically invest the most in their new housing. In fact, according to a survey by the National Association of Home Builders, in the first year alone homeowners spend over $13,000, with an additional $7,000 in year two.

- Reduced impact of high interest. Especially with today’s record high rates, even a temporary interest reduction can help you offset your first few years of homeownership and replenish those savings you spent on your down payment and closing costs. However, if you have reason to believe interest rates will come down in the future, that can lead to even further savings—particularly if the alternative is locking in a high-interest 30-year mortgage.

- No pressure to secure seller assist financing. A 2-1 buydown requires securing some sort of seller assist financing from the current owner or builder—and they are often used to attract buyers in slow markets. But in tight, competitive markets, you have a much lower chance of scoring this perk—and they sometimes come at the tradeoff of a higher price for the home itself. With a 5-1 ARM, you are in control. You can get a 5-1 ARM in any housing market, and aren’t reliant on the seller or builder to get your initial reduced interest rate.

Dangers of the 2-1 Buydown Mortgage

While 2-1 buydown mortgages do have a similar benefit in reducing your initial monthly payments, they do come with some potential pitfalls. If you go down the path of a temporary buydown, these are some things to watch out for:

- Getting too comfortable with lower monthly payments. While you do need to be approved for the actual interest rate and payments with a 2-1 buydown, if you get used to the lower payments in year one—and even in year two—it can be hard to adjust your spending levels when your payments rise in the third year, putting you at risk of overspending or not being able to afford your payments.

- Refinancing doesn’t pan out. If you get a 2-1 mortgage thinking you will refinance before your higher rate kicks in down the line, keep in mind that refinancing isn’t a guarantee. Rates could be just as high, or not low enough to offset the cost of restarting a new, 30 year loan with a new amortization schedule and all new closing costs. Additionally, refinancing may require another down payment, depending on your lender and the appreciation of your home. All these factors can be a deterrent for borrowers, meaning refinancing isn’t always something you can count on.

- Still need to pay PMI on top of payment increase. PMI (private mortgage insurance) is required for home loans where the borrower has not paid off 20% of the home’s value. If you don’t put 20% down at closing, this fee (usually up to about 1.5% of your loan) will be part of your monthly payment. Many people getting 2-1 buydowns who don’t put 20% down may hope to hit that mark within the first few years, eliminating their monthly PMI by the time their higher rate and higher payments kick in. But if you don’t, keep in mind your PMI fee will be added on top of your note rate increase. If you are getting a monetary seller assist, it may make more sense to use those funds to increase your down payment instead (more on this below).

- Rates could come down. This is perhaps the biggest drawback of 2-1 buydown mortgages when you utilize them when interest rates are high. If rates come down, your locked rate could be much higher than the new current market rate, meaning an ARM would have been a better choice.

How do I know if mortgage rates will change?

Mortgage rates are in constant flux, and it’s impossible to predict with complete accuracy what rates will be down the line. However, there are some economic predictors including historical rates that can give us a general idea in some circumstances.

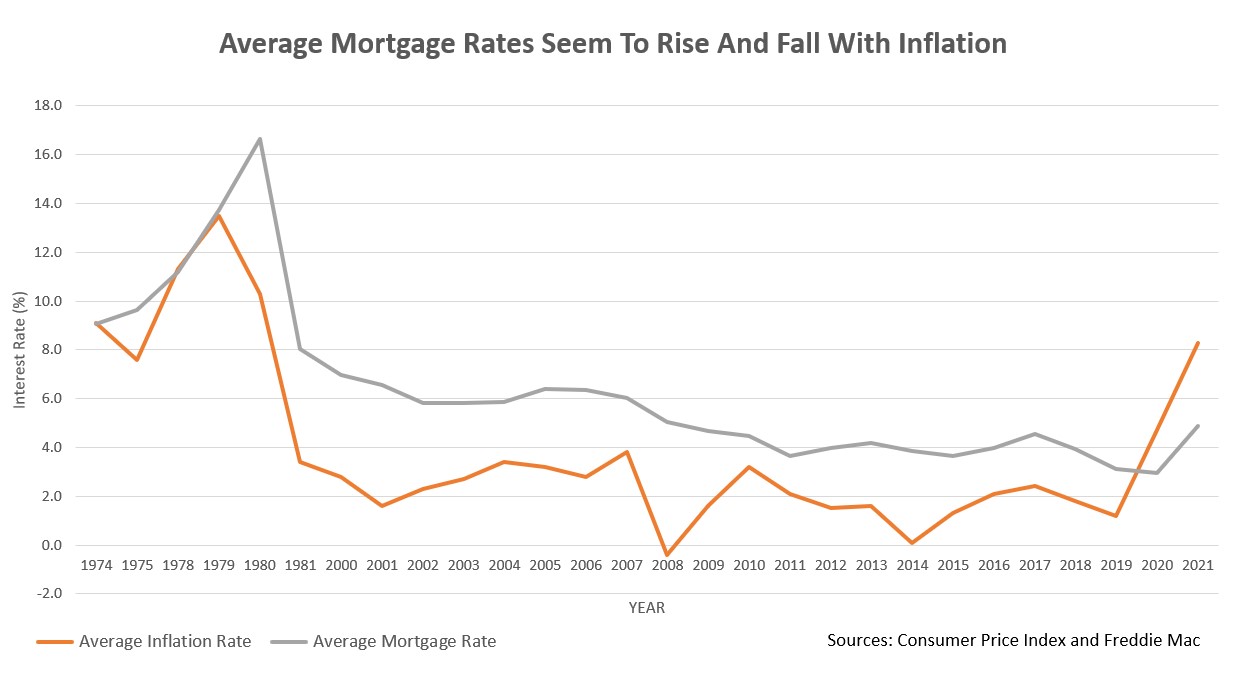

Inflation can have a significant impact on mortgage rates. That’s because when interest is low, people tend to spend more, which can result in higher levels of price inflation on goods as demand exceeds supply. The Federal Reserve’s FOMC (Federal Open Markets Committee) sets monetary policy to maintain low (or acceptable) levels of inflation—typically targeting 2-3%. The Federal Reserve takes measures to counter excessive inflation by raising their borrowing rates for overnight deposits (banks borrow from other banks’ deposited overnight reserves) during periods of high inflation. This in turn influences the rates that banks set for their own lending. Higher interest rates for consumers on home loans, auto loans, and other forms of credit ultimately slows consumer spending, bringing down inflation.

What does this mean for borrowers? Eventually, inflation will slow, prices will stabilize, and the Federal Reserve will once again lower interest rates. If rates are high due in part to inflation (as they are now), you can expect that they will likely come down again in the future. As we mentioned earlier, there seem to be strong indicators that the Federal Reserve will do just that in 2024.

But inflation isn’t the only thing that we can track to help predict future rates. Mortgage rates are affected by two other items: supply-and-demand in your residential housing market and the 10-year Treasury rate.

When fewer people are buying homes in your regional market, rates may decrease (marginally) to encourage new home purchases. That’s not to say there will be drastic interest rate differences across the country—but smaller regional differences are quite common. As Housing Wire shows, interest rates can vary across states by up to .2% on average, with Virginia having rates that tend to fall on the lower end. When local markets cool, expect lower rates to follow.

The 10-year Treasury rate can have an even greater effect on mortgage rates. Treasury notes are just one of many securities investments people can make, and are often chosen because they tend to carry very little risk. Mortgage-backed securities on the other hand, tend to offer higher yields, but carry more risk. As yields for 10-year Treasury notes rise in the face of inflation, investors for mortgage-backed securities will want to earn even more because of the associated risk. And to fulfill the demand for higher yields, interest rates will increase, to provide that additional money. In the near future, Treasury rates are expected to continue to rise. However, once inflation is under control, Treasury yields will likely fall once more, and with them, mortgage rates.

All of these economic factors can be difficult to follow and predict. The best thing to do is speak to a financial professional before making a decision on the right loan product. Although changes in rates are never guaranteed, if you believe interest rates will fall in the coming years, that might incentivize getting an ARM over a fixed-rate mortgage product.

Three Alternative Ways to Use Sellers Assist Money

If you are lucky enough to swing a seller concession, don’t feel limited to a temporary interest buydown—even if that is what the seller or builder initially offers you. There are a number of other options out there that might make greater financial sense in the loan run, including:

- Increasing your down payment. Even if you choose an ARM mortgage, you can utilize a seller assist to reduce your out of pocket closing costs. You can transfer the savings on closing costs to a larger down payment to additionally reduce your monthly mortgage payments and maybe even avoid PMI altogether.

- Using funds to offset moving costs, furnishings, and minor renovations. If you already have a sufficient down payment, but find your savings depleted after purchasing your home, you may want to use the seller assist to offset the many expenses you’ll encounter moving, furnishing your new house, and making small renovations to make it feel like a home.

- Purchasing discount points to permanently lower your interest rate. 2-1 buydowns are temporary reductions in interest rates. However, you can purchase discount points to permanently reduce interest rates—especially when rates are high. The cost of a discount is typically 1% of your loan amount, and lowers your interest rate .25 percentage points.

Is an Adjustable Rate Mortgage right for you?

Interested in learning more about ARMs? Reach out to a mortgage professional at F&M Bank today to find out if an adjustable rate mortgage makes sense for you. Our lenders can discuss all the options available to you given your specific situation, provide hypothetical amortization schedules, and help you decide what home loan product is the best choice for you to get you in your new home.

* Results are hypothetical and may not be accurate. This is not a commitment to lend nor a preapproval. Consult a financial professional for full details. Hypothetical payment scenarios do not include taxes and insurance, which will result in a higher payment.