Maximizing Efficiency and Security: Cash Management Solutions for Businesses

In today’s fast-paced business environment, having control over financial processes is key to success. Whether you’re a small business or a large corporation, managing cash flow efficiently and securely is essential. At F&M Bank, we provide insight into how cash management products can streamline operations, enhance security, and ultimately help businesses thrive regardless of your business size.

With the increase in fraud activity the industry has seen in recent years, we sat down with Robyn Good, our Vice President and Treasury Management Officer to discuss her recommendations for businesses wanting to remain proactive about managing their funds movement. Robyn is a lifelong Shenandoah Valley resident with over 35 years of banking experience; 17 of those years have had a specialized focus on business deposits and fraud solutions.

What are Cash Management Products, and Why are They Important for Businesses of All Sizes?

Cash management products offer businesses tools to simplify and streamline their financial processes. With real-time account monitoring, companies can reduce the risk of fraud and better manage day-to-day financial operations.

Robyn: “Every business, regardless of size, needs to protect their accounts and monitor activity with ease. With cash management solutions, businesses can oversee multiple transactions and spot potential fraud much faster, giving them more control.”

How Do Business Online Banking Solutions Simplify Cash Management?

Online banking solutions tailored for businesses go beyond the basics of consumer banking. Features like recurring payments, vendor payments, positive pay, and stop payments are invaluable for businesses looking to grow and maintain efficiency.

Robyn: “Cash management allows businesses to pay vendors electronically and manage payments seamlessly. This is vital for businesses looking to expand and build a reputation of reliability.”

Popular Cash Management Products for Businesses

Our most recommended products include:

- Positive Pay: This service helps prevent check fraud by verifying checks presented for payment against checks issued by the business.

- ACH Origination: This allows businesses to easily process electronic transactions, from payroll to vendor payments, providing speed and security.

The Benefits of Automated Clearing House (ACH) Services

ACH services help businesses mitigate risks associated with physical checks. By processing payments electronically, businesses can protect their sensitive account details and gain better control over payment timing.

Robyn: “ACH services offer speed and reversibility, making it a preferred option for many companies handling payroll or vendor payments.”

Streamlining Processes with Remote Deposit Capture

Remote Deposit Capture (RDC) simplifies the check deposit process for businesses. Instead of making a trip to the bank, businesses can scan checks and deposit them directly from their office.

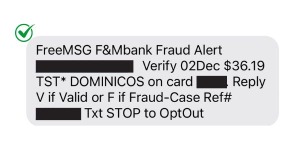

Enhancing Security with Business Online Banking and Cash Management

Security is a top priority when it comes to online banking. From multi-factor authentication (MFA) to setting access controls for employees, businesses can secure their online transactions and banking activities.

Robyn: “Our online banking system allows businesses to set time-of-day and IP address restrictions, ensuring that unauthorized individuals cannot access sensitive financial information.”

Positive Pay: A Must-Have for Preventing Check Fraud

Positive Pay is a powerful tool in preventing check fraud. It matches details like check number, issue date, payee, and dollar amount against a list of checks authorized by the business. If any discrepancies arise, the business is immediately alerted to review and approve or reject the payment.

This system ensures that unauthorized or altered checks don’t slip through, protecting your business from potential fraud.

Clearing Up Common Misconceptions About Cash Management

Cash management services are often seen as complex or unnecessary, but they are designed to simplify processes. “It’s a value-add to the relationship with the bank,” our team shares. “These services are user-friendly and provide a depth of visibility that businesses need for security and growth.”

The Future of Cash Management

As fraudsters become more creative, the importance of cash management products continues to grow. The future of cash management will focus even more on electronic transactions, reducing the need for checks and ensuring that businesses have the tools to safeguard their assets.

Robyn: “We expect ACH to become even more integral as businesses prioritize speed and security. “The right safeguards will keep businesses one step ahead.”

With the right cash management solutions, businesses can take control of their financial processes, mitigate risks, and set themselves up for growth.

Interested in learning more?

Contact Robyn today for a free consultation and discuss how our solutions can benefit your business.