Should I Bank Local in Virginia? What to Consider When Choosing a Financial Institution

Are you new to the Shenandoah Valley and having trouble deciding on where to bank? Unhappy with your current financial institution and looking to switch? Whether you’re looking for a financial institution for personal deposit accounts, mortgage financing, or business banking needs, it can be tough to decide whether to choose a large bank that you see across the country or a local bank with roots in your community, such as F&M Bank. In this article, we’ll help you understand what makes local financial institutions stand out, along with some perks of community banks that you may not be aware of.

What are the different types of financial institutions?

Banks are a crucial part of the U.S. monetary system because they move U.S. currency and provide necessary liquidity to personal and business entities. There are two sets of bank regulators, Federal and State. At the federal level, The Office of the Comptroller of the Currency (OCC), part of the Treasury, charters and supervises national banks. At the state level, banks that don’t work across state lines can be state-chartered. The FDIC oversees state-chartered banks that aren’t members of the Federal Reserve System.

F&M Bank can be traced to 1908, when it started its operation as a state-chartered bank; in 1983 F&M Bank was incorporated in Virginia and became a registered bank holding company. As a bank holding company it is a full-service financial institution, offering complete consumer, business, and financial services – including a full array of digital banking capabilities as well as physical branch locations for your banking needs (as opposed to institutions such as Internet-only banks and credit unions). You will even find that F&M Bank’s online services offer the same capabilities as national banks!

- Internet banks: No physical branches, just a website and mobile banking app. Online banks may not have national charters themselves, instead partnering with a traditional bank to hold customer deposits.

- Credit unions: Financial institutions that are owned by their members and have certain criteria for membership.

Differences between banks and credit unions

Working with a local financial institution like F&M Bank will likely be your best option. When deciding on where to open a bank account, consider some of the key differences between banks and credit unions:

- Credit unions typically have fewer branch locations and financial products/services than banks.

- Local community banks like F&M Bank benefit their community through local partnerships, events, and volunteer opportunities.

- F&M Bank offers the most convenience and resources through digital banking on your mobile or other personal devices, along with a variety of options for nearby, conveniently located physical branch locations.

- Local banks like F&M Bank offer unrivaled expertise related to your community, understanding how to resolve your specific needs for personal and business banking and lending that credit unions or nationwide banks are unable to provide.

Benefits of banking local for your personal deposit accounts

When it comes to your checking and savings accounts, it’s nice to have branch locations conveniently located near your house or job. And not just any branch, but one staffed with friendly employees who live and work in the same community as you. For example, F&M Bank has developed a lot of local expertise over the years. We’ve been supporting personal banking needs in the Shenandoah Valley since 1908. Local banks like F&M also offer branch services like on-site safe deposit boxes and in-house notary services.

Of course, web-based banking tools mean you don’t have to visit a branch just to deposit a check or transfer money between accounts. Local banks have embraced technology in recent years and now offer the same tools as the bigger banks. Enjoy the convenience of banking where and how you want with online banking, mobile banking, person to person payments, and mobile wallet. F&M Bank’s rating in the App Store is 4.8 out of 5 stars – higher than you will find for other options both nationally and locally.

Benefits of banking local for your lending needs

Applying for a loan can be stressful, especially if it’s your first time. The friendly loan officers at your local bank can guide you through the process, turning it from stressful to smooth and pleasant. Whether a home, car, or personal loan, they’ll help you review your options to find the right loan with a payment plan you can afford.

Mortgage Lending

While there are national trends in real estate, it’s still a very local business. The housing market can vary widely from community to community, so working with a local mortgage lender gives you access to local expertise, as well as more flexible lending options. Learn more about the mortgage loans offered by F&M Bank.

Personal Loans

Whether you need an Auto Loan to finance the purchase of your next vehicle, or a general consumer loan to use for a variety of expenses, local decision-making helps you get the right loan. Enjoy swift and local application processing, and greater flexibility in approving loans, from your local bank. When you come to a local lender like F&M Bank, we aim to put you at ease with the loan application process. Learn more about our personal loans.

Benefits of staying local for Wealth Management

Choosing a financial advisor is all about trust. Will they put your best interests first? Do they have experience working with clients who share your background, such as small business owners, blended families, etc.? Whether you are in Harrisonburg or closer to Broadway and Edinburg, you can find local financial advisors who will offer a higher level of service and possess a wealth of local knowledge.

Staying local for Wealth Management means working with a financial advisor who understands your community and can recommend local investment opportunities such as those on our Local Market Dashboard.

Investment and insurance products and services are offered through Osaic Institutions, Inc., Member FINRA/SIPC. F&M Financial Services is a trade name of F&M Bank. Osaic Institutions and F&M Bank are not affiliated.

Securities and Insurance Products:

Not Guaranteed by the Bank | Not FDIC Insured | Not a Deposit | Not Insured by Any Federal Government Agency | May Lose Value Including Loss of Principal

Bank local with F&M!

Now that you understand the benefits of banking locally, you probably want to find a local financial partner who understands your needs. At F&M Bank, you’ll find personalized attention with customizable solutions for your personal banking needs. In-house decision-making simplifies loan applications and local financial planners understand the community they serve. Get started now! Contact us or visit your nearest branch location in Harrisonburg, Augusta County, or Staunton in the Shenandoah Valley.

National Ag Day with F&M Bank

National Ag Day

National Ag Day is March 22, 2022! Virginia’s agricultural production is one of the most diverse in the nation. Many Virginia commodities and products rank in the top 10 among all U.S. states. Our local farmers, and other agriculture experts, represent a leading group of industry movers and shakers that support our economy and sustain life for our region, and beyond.

Virginia is home to over 43,000 farms that cover nearly 8 million acres across the Commonwealth. 98% of all farms in the United States are family-owned and operated. These families sacrifice a lot to feed our communities and sustain life throughout our region. F&M strives to thank farmers throughout the year and we encourage our community to take a moment next week to thank a local farmer as we celebrate our farming community!

F&M has been supporting local farmers for over 100 years. We’ve helped farmers navigate several economic cycles from recessions and droughts to boom periods with flourishing production. These experiences and partnerships have helped us develop tailored products that include equipment financing, land expansion, cattle purchases, waste management funding, and lines of credit.

Learn More about our line of Ag products, or contact one of our Agri-Business specialists at agribusiness@fmbankva.com.

How to Open a New Account Online

ONLINE ACCOUNT OPENING

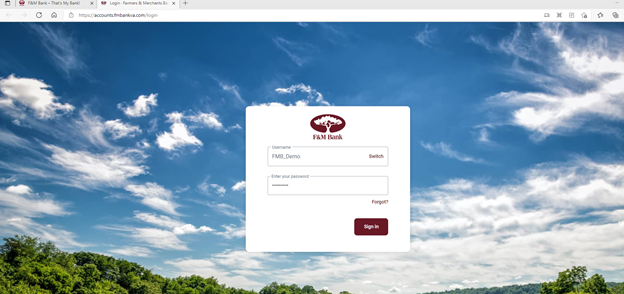

Open a browser and navigate to https://www.fmbankva.com/

If you are an F&M Bank customer with an online banking user ID and password, enter that information at the top right to login.

If you need to enroll in online and mobile banking, choose Enroll in Online Banking directly beneath the login portal.

Enter your User ID and password to login to online banking and open your new account.

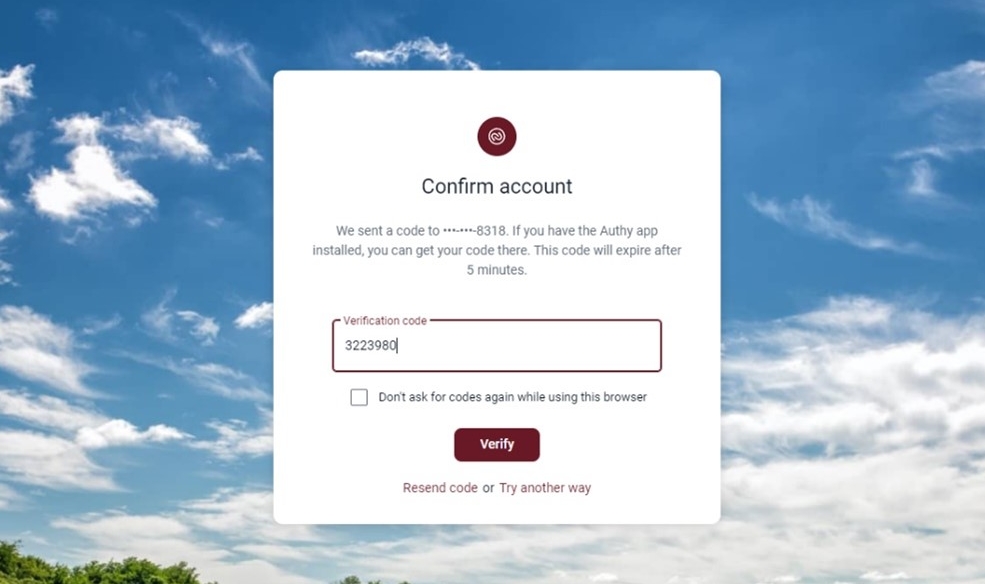

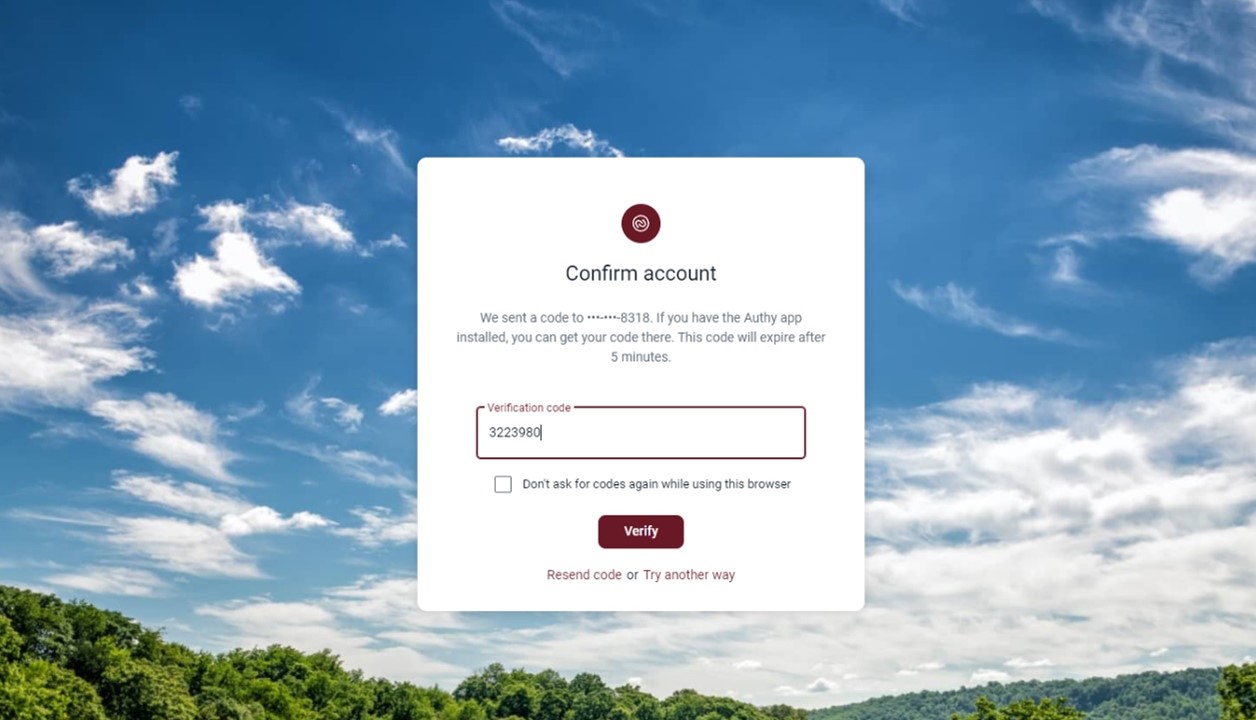

Please note, for security purpose, two-factor authentication is required. A temporary passcode by text message, phone call, or by Authy app if previously installed.

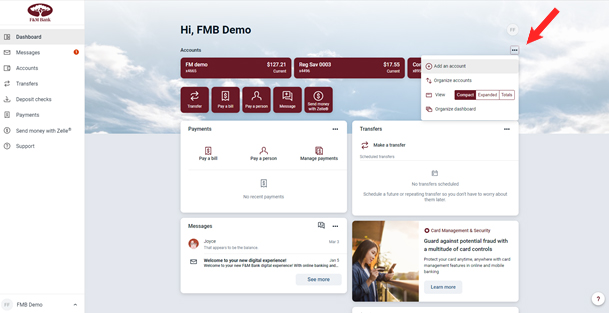

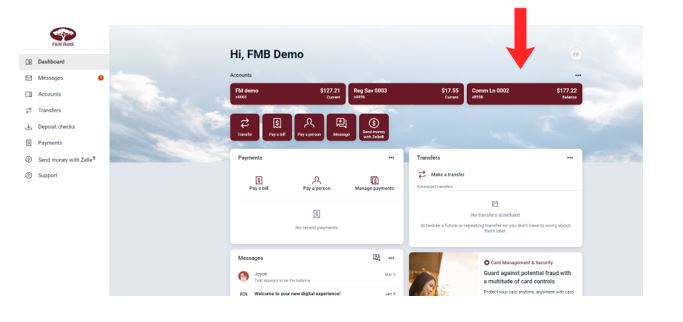

Click once on the three dotted button at top right (…)

Choose Add an account and on the next screen, click on Open an Account.

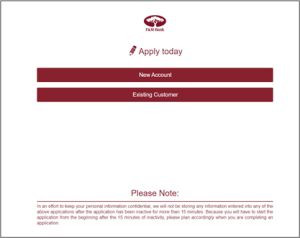

If you do not have an F&M Bank account, choose New Account to get started.

If you are an F&M Bank customer, choose Existing Customer to get started.

Please note: After 15 minutes of inactivity, the process will time out for your security.

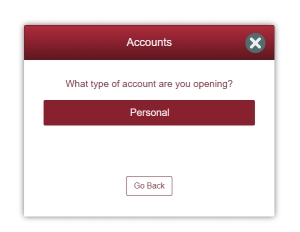

On the next screen, click on Personal.

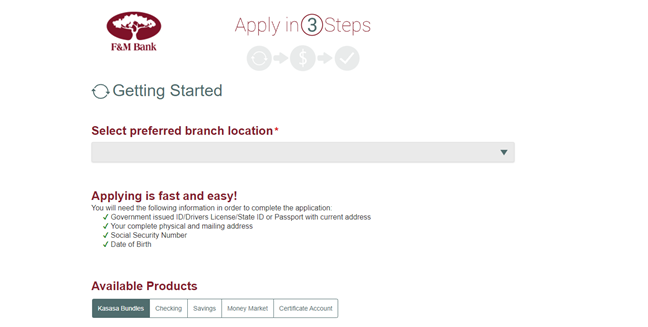

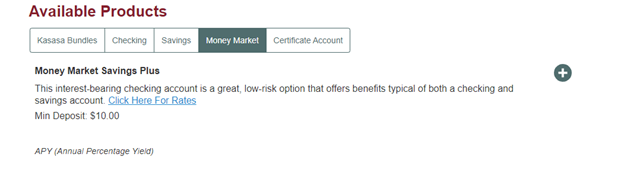

Here, you will choose your preferred banking location along with the account you would like to open: Checking, Savings, Money Market or CD. You are only a few steps away from your new account!

Be sure to click the + sign to choose your debit card option.

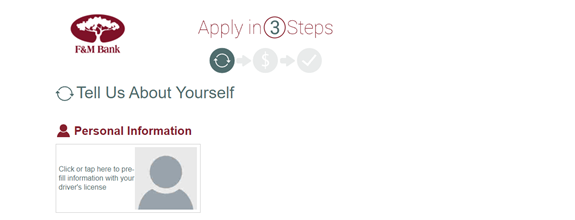

On the next screens you will enter your personal information, contact details, joint account, and beneficiary status, and upload a photo of your Driver’s License or State Issued Photo ID. If you are a current F&M Bank customer, some of the information will auto-fill for your convenience.

Once you complete the steps listed above, you will be prompted to review disclosures, and electronically sign to approve your new account.

Within two business days, you will receive a confirmation email from F&M Bank. If no action is taken, you will receive a reminder email after ten days.

Congratulations on your new F&M Bank account! We value your business!

How to Make a Loan Payment Online

Open a browser and navigate to https://www.fmbankva.com/

If you are an F&M Bank customer with an online banking user ID and password, enter that information at the top right to login.

If you need to enroll in online and mobile banking, choose Enroll in Online Banking directly beneath the login portal.

Enter your User ID and password to login to online banking.

Please note, for security purpose, two-factor authentication is required. A temporary passcode will be delivered by text, phone call, or by Authy app if previously installed.

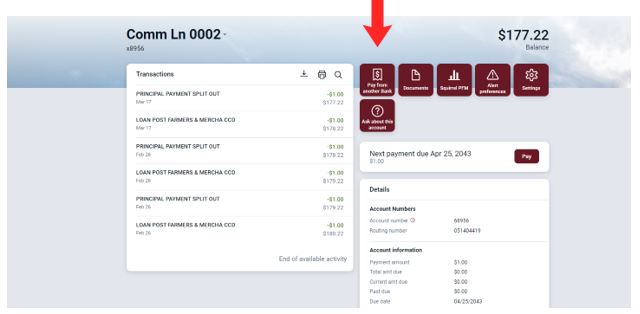

Click on the tile with your loan account information

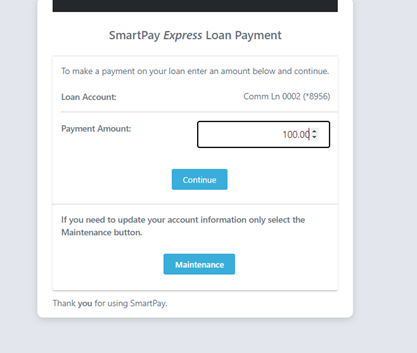

Click on the tile Pay from another Bank

Enter your payment amount and click continue.

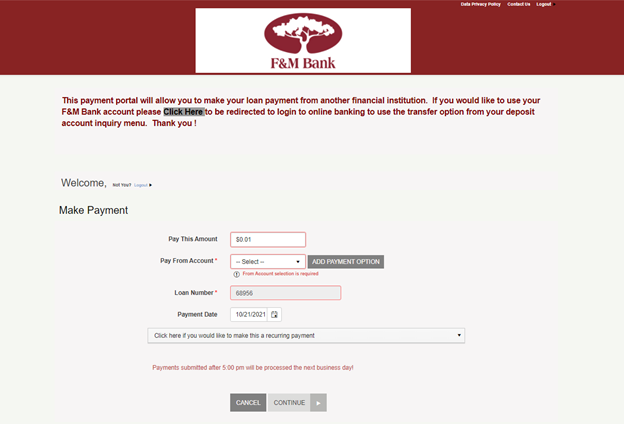

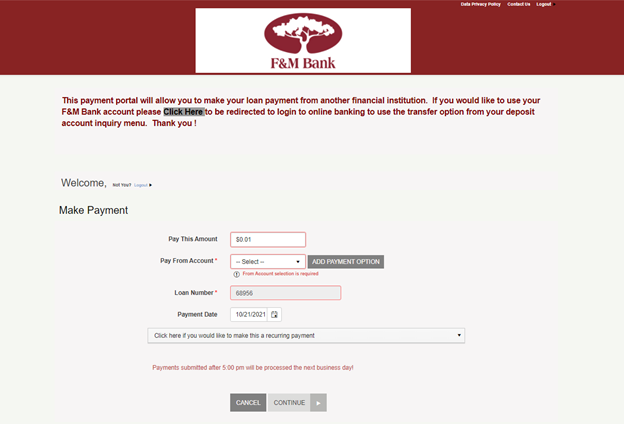

On this screen, click the down arrow beside Pay from Account to select from a payee that has been previously setup. Click Continue and confirm your payment on the next screen. You will receive a confirmation email that payment has been issued.

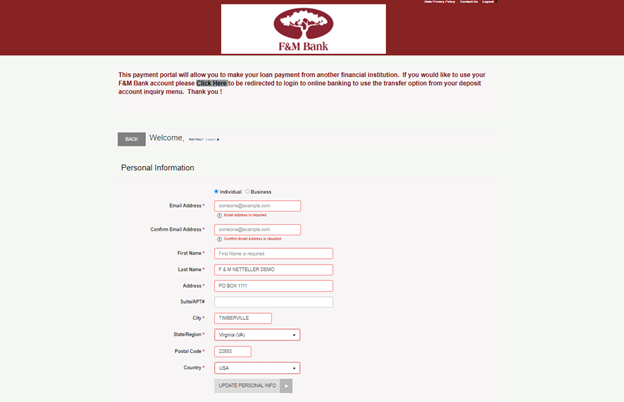

To setup a new payee, click the grey box for Add Payment Option shown above.

On this screen, confirm your personal information is correct and enter the information for your external payment options. Click add payment.

Now that your new payee has been added, you will be redirected to the previous screen.

Click the down arrow beside Pay from Account to select your payee, click continue and confirm your payment on the next screen. You will receive a confirmation email that payment has been issued.

Thank you for making your loan payment online with F&M Bank!

How to Make a Loan Payment with Online and Mobile Banking

Making your personal or auto loan payment is simple and easy with online and mobile banking from F&M Bank. If you have previously enrolled in online banking, please skip to Step 2. If you are not enrolled in online banking, please follow Step 1 to enroll.

STEP 1 – ON YOUR COMPUTER

Online Banking

Open a web browser and type accounts.fmbankva.com/enroll and enter your:

-

- Social Security number

- Account number

- Email address

- Phone number

STEP 1 – ON YOUR PHONE

Mobile Banking

-

- Open the camera app on your phone;

- Open your phone camera app and place over QR code below;

- Open the link that appears on your screen;

- Download the F&M Mobile Banking App and click “Enroll”

QR code not working for you? No problem! Simply open the App Store for iPhone or Google Play for Android and search for “F&M Mobile – VA” (image shown below) to enroll.

To make your loan payment, follow these simple steps!

STEP 2: Under “Select account type,” click on “Personal”

STEP 3: Enter your Loan Account Number

STEP 4: Enter your Social Security Number and Date of Birth

STEP 5: Click “Continue” and follow the simple instructions

Once you’ve enrolled, you’ll be able to schedule your payment by clicking on “Loan Information” and then selecting “Pay from another bank.”

Check out instructions for how to make your loan payment on the F&M Bank blog:

fmbankva.com/how-to-make-a-loan-payment-online

Set up payments within F&M Online and Mobile Banking.

If you are currently enrolled in F&M Online & Mobile Banking, you can pay your loan by clicking on “Loan” and select “Pay from Another Bank” to setup your external account.

Cash Flow, Debt, & Refinancing for Virginia Small Business Owners

Are you wondering if you should refinance a small business loan? Many businesses experienced the unexpected last year, and now it’s time to get back on track or strengthen your existing operation. Small business debt consolidation or refinancing could be an important part of your strategy this year. In this article, we’ll explain how to refinance business debt, cover the pros and cons, and show you how to get started. If you have any questions, call us at (540) 896-8941.

What is Debt Refinancing?

When you refinance debt, you take out a new loan (usually with better terms and/or interest rate) and use it to pay off the old loan. The main benefits of refinancing include saving money on interest, reducing your monthly payment amount, and/or changing the loan term.

When it comes to business debt, consolidating your existing loan(s) with a lower-interest commercial loan can boost your cash flow by lowering your monthly payment and shortening your repayment period.

What to consider before refinancing small business debt

There’s more than one reason to consider refinancing your small business loan(s). Perhaps the payments you’re making on your current business loan primarily go toward interest rather than principal. Refinancing your business loan, also known as debt consolidation, can help you qualify for a longer-term loan with more affordable rates. Here are the most important factors to consider before applying:

- Debt refinancing does involve paying interest on any interest already compounded in your current loan.

- Does the loan you’re looking to refinance have prepayment penalties? Check the fine print first.

- Have interest rates fallen since you took out your current loan? Consolidating your business debt into a lower interest loan could free up extra cash to put toward other needs and expenses.

- Has your total debt level changed since the original loan was made? Business lenders will want to know the debt-service coverage ratio (DSCR) for your company. DSCR is used to calculate your business’s solvency and ability to repay your debt. So if you’ve taken on more debt recently, you may have trouble qualifying for an attractive refinance loan.

Now that you’ve considered different factors, your ultimate decision should depend on what you’re hoping to get out of your debt refinance. For example, in spite of a downside, loan consolidation may still be the right move for your business if you’re looking for a longer repayment term, lower interest rate, and/or less frequent payments.

5 Questions to ask your business lender about debt refinancing

When pursuing any kind of business loan, including debt refinancing, don’t be afraid to ask questions. Your business lender is here to help you review all business loan options and find the best solution to meet your needs. Here are some of the things you may have questions about:

- How long will my new loan term be?

- What are the closing fees?

- Will the loan have a fixed or variable interest rate?

- Is there a prepayment penalty?

- If I don’t qualify for debt refinancing now, what can I do to improve my application next time?

Debt Consolidation vs. Refinancing

While debt consolidation and debt refinancing can be used interchangeably, there are some differences between the two. Here’s what you need to know:

- Debt consolidation is a type of debt refinancing.

- The purpose of debt consolidation is to take several different loans or credit card balances and pay them all off with one new loan.

- Debt refinancing generally takes one loan and replaces it with a new one to achieve a better interest rate and loan terms.

- The process of applying for debt consolidation or refinancing is the same. You’ll need to provide basic information about your business’s financial situation and credit history. You’ll also need to list the debt(s) you will be paying off with the new loan.

Pros and Cons of Debt Refinancing

As with any big financial decision, it’s important to weigh the pros and cons first.

Potential Downsides of Refinancing

- Prepayment penalty: Does your current loan have a prepayment penalty? If so, how much? You may still save more in interest by refinancing, but it’s something to check out. Also, if you really need to reduce your monthly debt payment to improve your cash flow, it may still be worth paying the prepayment penalty.

- Getting stuck in a debt cycle: If this isn’t your first time refinancing, you may want to take a closer look at your business’s financial situation. Will refinancing this time help you pay the debt off or are you just perpetuating a debt cycle for your business?

Benefits of Debt Refinancing

- Lower your monthly payment to improve cash flow and invest in your business.

- Lower your interest rate to save money and off your debt faster.

- Potentially improve your credit score

- Refinance into a larger loan to take “cash out” and invest in your business or meet working capital needs.

How does debt refinancing work?

To start the debt refinancing process, apply for a new business loan from your business lender. At F&M Bank, we offer a variety of business loans, including small business financing through the SBA and traditional term loans for qualified borrowers. And as a longtime community bank, we are dedicated to investing in and supporting small businesses throughout the Shenandoah Valley. Our business lenders pride themselves on building lifelong relationships with clients.

Learn more about debt refinancing from F&M Bank!

Since 1908, F&M Bank has been offering business banking services in the Shenandoah Valley and beyond. Trust the future of your business to our expert lending team. Wherever you are in the Shenandoah Valley, from Harrisonburg to Staunton, you can contact a member of our team or visit one of your local branches in Augusta, Page, Rockingham, or Shenandoah county to learn more about debt refinancing or to apply for a new business loan today.

Our friendly and experienced business lending team is ready to answer your questions and help you make the best choices for your company. Have questions? Get in touch today!

Benefits of Banking Local for Small Businesses in the Shenandoah Valley

Small business owners encounter many challenges in running a local business—banking shouldn’t be one of them. If you’re looking for the best bank for small business, look no further than Main Street. Your local bank offers the same products and services as the bigger banks, but with more flexibility in making lending decisions and saving you money on interest and fees. As reported by a 2020 Community Banking Study from the FDIC:

“Community banks provide their local communities with valuable products and services, including offering various loan products to business owners and developers, small businesses, and farms … Community banks also continue to meet the credit needs of less economically vibrant areas, such as rural counties experiencing population outflows.”

So, whether you are a relatively new small business owner looking to build a banking relationship, or you’re not satisfied with your current lender and looking for better rates/terms, keep reading to learn all the benefits of banking locally for small businesses in the Shenandoah Valley.

Personalized Banking Experience

One of the biggest decisions you can make is how to choose a bank for your business. When you choose a local bank like F&M for your business banking needs, you get more than a banker or lender. Instead, consider us the newest member of your team. We build relationships with our business clients to support your needs and growth throughout the life of your business.

So, what does a personalized banking experience look like?

- Anticipating your individual needs

- Customizing loans and other services to meet your needs

- Providing information and advice to support your business goals

- Making ourselves available when you have a question

With personalized service, you are never just another account number. It saves you time to work with a local bank that knows your community and your business’s place in it. By anticipating your individual needs, we can make recommendations before you even realize it’s time to take the next step. Take it from Barren Ridge Vineyards in Fishersville, Augusta County:

“We have found F&M Bank to be everything a local bank should be: a bank that heard our story and believed in and supported our vision.”

Plus, we care about the same things you do. From volunteering with local charities to cheering for our kids at local sporting events, don’t be surprised if you run into your local business banker outside of the bank!

Customized Financing with Competitive Rates

When it comes to lending options for small business, local banks represent more than their share of the market:

“Community banks represent 15 percent of the industry’s total loans but 30 percent of its CRE loans, 36 percent of small business loans, and 70 percent of agricultural loans,” according to the same FDIC study. This shows that while local banks may have a relatively small footprint, they are the lender of choice for many small businesses and farmers. Let’s take a closer look at the reasons why:

- Local banks often have more flexibility. With lending decisions made locally, there is more flexibility to lend to small businesses and customize financing.

- Community banks offer lower fees and interest rates. In part because they are locally owned, local banks are able to help businesses save money on loan rates and fees for other business bank accounts and services. Every dollar saved makes a difference to a small business.

- You don’t have to give up convenience. Local banks tend to offer the same perks and services as bigger banks such as online and mobile banking, remote check capture, credit card processing, and more.

- We understand local needs and concerns. Community banks are part of the local economy, which thrives when local businesses are thriving. That’s why we are often able to approve small business loans that would likely be rejected by bigger banks.

As you can see, it pays to build a relationship with your local banker. When you need financing, we will make every effort to provide you with affordable loan terms and rates.

Community Focused, Just Like You!

If you’re still wondering, should I bank locally for my small business lending needs, keep in mind that the money you put into your local bank through deposits and interest paid on loans gets reinvested in your community through other loans and donations to nonprofits.

“F&M Bank is an exemplary model of what it means to be a community bank. Their support and involvement with local business and nonprofits is unparalleled, and we are proud to partner with them,” writes Kristi Williams, President & CEO United Way of Staunton, Augusta Co. & Waynesboro (SAW)

Local banks support the community in many ways, such as sponsoring local sports teams, financing construction in the community, and helping small businesses get on their feet and grow. So, when you choose a local bank for your business banking and lending needs, you are also reinvesting in the community. Larger banks often lack those social ties and interconnected relationships with the local economy and community.

Partner with F&M Bank for your business banking needs!

Are you looking for the best business lender in the Shenandoah Valley? For the past century, F&M Bank has helped local businesses like yours grow and thrive. Whether you’re expanding, remodeling, or making a business move, we tailor your loan to meet your needs. Our team walks you through the process and guides your experience with the personable attention your business deserves.

To get started, visit or call one of our convenient locations across Augusta, Rockingham, Shenandoah, and Frederick counties.

Protect Your Business from Check Fraud with Positive Pay from F&M Bank

More and more people are falling victim to financial fraud and check fraud can affect your small business as well. While many business owners have simply stopped using checks, many of those same customers continue to use checks to pay their business expenses.

So how do you protect yourself and your business from fraudulent checks? If ceasing to use or accept checks in your business is not an option, there are other ways to prevent check fraud from impacting your business.

One way is to add Positive Pay to protect your commercial checking account.

→ Positive Pay matches the account number, check number, issue date, payee and dollar amount of each check presented for payment against a list of checks previously authorized and issued by your company.

→ Each time a check or series of checks are issued, a file of those checks containing the check number, issue date, payee and dollar amount is uploaded into online banking by your company. If a potential fraud occurs, you will receive an alert in online banking and be prompted to approve or reject the payment

→ Ways to reduce false positives and therefore work load of company employees:

- Upload files of issued checks as they are dispersed. Any check not uploaded to the system presented for payment will reject;

- Follow font best practices and guidelines (as shared by F&M Bank)

Interested in learning more? You have options!

→ Contact your local banker

Use the Support feature when you are logged into online or mobile banking to start a conversation.