Don’t Just Open a Bank Account- FOCUS On the Right One

Opening a bank account might seem like a simple task, like grabbing a coffee – quick and easy. But it’s a far more crucial step in managing your finances, more like choosing a place to live. Whether you’re sticking with F&M Bank in the Shenandoah Valley or checking out other local banks, don’t rush into it! Choosing the wrong account can lead to unexpected fees that chip away at your savings, limited access that makes managing your money a hassle, and a general sense of financial frustration.

In this post, we’ll introduce the FOCUS method – a simple acronym to help you navigate the process and find the perfect bank account!

What is FOCUS?

FOCUS is your guide to smart banking. It’s a handy way to remember the key elements and questions to ask when choosing a bank account. It stands for:

- Financial (Needs and Goals)

- Options (Benefits and Limitations)

- Clarify (Fees and Costs)

- Understanding (Future Needs)

- Security (Security Measures)

Let’s break down each element of FOCUS and explore the key questions you should be asking, turning you from a passive account opener into an informed financial decision-maker.

Financial: Know Your Needs and Goals

Before you head to the nearest F&M Bank branch, take some time for some financial self-reflection. Ask yourself:

- What are my short-term financial goals? Are you saving for a new phone? Just trying to manage your everyday expenses? Knowing your immediate needs will help you determine the type of account and features you require.

- What are my long-term financial goals? Are you dreaming of a down payment on a house? Planning for retirement? Your long-term aspirations will influence the kind of banking relationship you need.

- What type of account best suits my needs? Do you need a simple checking account for daily transactions? A high-yield savings account to grow your nest egg? A money market account for larger sums? Understanding the different types of accounts is essential.

- How often do I plan to use my account? Are you a frequent debit card user? Do you prefer online banking? Knowing your usage habits will help you prioritize certain features.

- What features are essential for me? Is online banking a must-have? Do you need mobile check deposit? Are you looking for a bank with a robust rewards program? Make a list of your must-haves.

Knowing your financial needs and goals is the foundation of smart banking. It allows you to choose an account that actively supports your financial journey, not one that hinders it.

Options: Explore Your Banking Options

Now that you’ve defined your needs, it’s time to explore the vast world of banking options. Don’t just settle for the first account you stumble upon! Compare the specific account types available and their benefits and limitations.

Benefits

For each account you consider, evaluate the benefits:

- Interest Rates: How competitive is the interest rate? Is it fixed or variable? How often is it compounded?

- Fees: Are there any monthly maintenance fees? How can they be waived? What are the fees for ATM usage, overdrafts, and other services?

- Online and Mobile Banking: How user-friendly is the online and mobile platform? Does it offer features like bill pay, mobile check deposit, and budgeting tools?

- ATM Access: How extensive is the bank’s ATM network? Are there fees for using out-of-network ATMs?

- Rewards Programs: Does the account offer any rewards, such as cashback, points, or travel miles?

- Overdraft Protection: What are the overdraft protection options? What are the associated fees?

- Customer Service: How accessible and responsive is the bank’s customer service?

- Other Perks: Does the account offer any other benefits, such as free checks, discounts on other financial products, or financial planning resources?

Limitations

Be aware of limitations for each account you’re considering:

- Minimum Balance Requirements: Are there any minimum balance requirements to avoid fees or earn interest?

- Transaction Limits: Are there limits on the number of monthly transactions you can make?

- Withdrawal Restrictions: Are there any restrictions on how often you can withdraw money from the account?

- Limited Features: Does the account lack any features that are important to you, such as online bill pay or mobile check deposit?

- Fees: We’ve mentioned fees before, but it’s worth reiterating. Pay close attention to all potential fees!

- Accessibility: Are the bank’s branches and ATMs conveniently located? Is customer service readily available?

Consider creating a simple comparison chart – a spreadsheet or even a handwritten table – to weigh the pros and cons of each account side-by-side. This will help you visualize the differences and make a more informed choice.

Clarify: Avoid Fee Surprises

Fees can be the silent killers of your financial well-being. Don’t make the mistake of assuming any account is “free.” Carefully investigate all potential fees. Ask about:

- Monthly maintenance fees (and how to avoid them): Many accounts charge a monthly fee, but often there are ways to prevent it. Find out the requirements (e.g., minimum balance, direct deposit).

- ATM fees (in-network and out-of-network): Using ATMs outside your bank’s network can be costly. Understand the fee structure and look for accounts with broad ATM access.

- Overdraft fees (and overdraft protection options): Overdrafts can lead to hefty charges. Understand how overdraft protection works and what the associated fees are.

- Transaction fees (e.g., wire transfers, stop payments): If you anticipate needing these services, be aware of the costs.

- Inactivity fees: Some banks charge a fee for accounts that haven’t been used for a certain period.

- Account closure fees: While you hopefully won’t be closing the account anytime soon, it’s good to know if there are any fees associated with doing so.

Understanding the fee structure is crucial to avoid unexpected charges and keep more of your hard-earned money in your pocket.

Understanding: Think Long term

Your financial needs are not static; they will evolve as you move through different life stages. Think about your future and consider the following:

- Will my banking needs change in the next few years? Are you planning to get married? Buy a house? Start a family? These life events can significantly impact your financial needs.

- Does the bank offer other financial products and services I might need in the future? Will you need a mortgage? A car loan? Investment accounts? Choosing a bank that offers a range of services can simplify your financial life down the road.

- Will I need access to branches in different locations? If you anticipate moving or traveling frequently, consider a bank with a wide branch network or convenient online and mobile banking options.

- Will I need international banking services? If you plan to live or work abroad, look for a bank that offers international transactions and ATM access.

Choosing a bank that can grow with you and adapt to your changing needs will save you time, hassle, and potentially money in the long run.

Security: Protecting Yourself

Protecting your money and personal information is non-negotiable. It’s like having a good security system for your house. Ask about the bank’s security measures:

- Is the account FDIC insured? This is essential! FDIC insurance protects your deposits up to $250,000 per depositor, per insured bank.

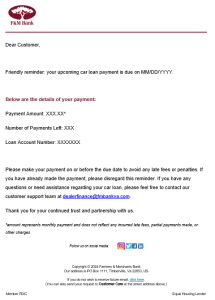

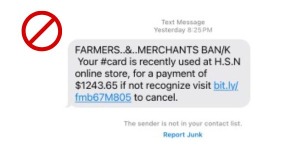

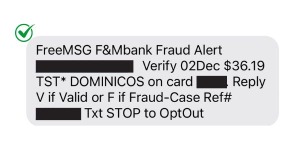

- What security measures are in place to protect my account from fraud and unauthorized access? Look for features like two-factor authentication, fraud alerts, encryption, and robust online security protocols.

- What is the bank’s policy on data breaches? While no system is completely impenetrable, it’s important to understand how the bank will handle a data breach and protect your information.

Knowing your money is safe and your information is secure provides invaluable peace of mind and is a non-negotiable aspect of choosing a bank account.

FOCUS When Opening a Bank Account

By using the FOCUS method, you can transform the often-daunting task of opening a bank account into a strategic and informed decision. Remember to take your time, don’t be afraid to ask questions, and compare your options carefully.

At F&M Bank, we strive to offer banking products that meet your needs—wherever you are on your financial journey. Our Basic Checking Accounts provide a simple, free option for money management, with free online and mobile banking, free debit cards, free financial advisor consultations, and free e-statements. And when you’re ready to move on to a premium account, we have several options to choose from.

Stop by one at one of our locations in the Shenandoah Valley to learn more about our checking account choices, or open an account online today!