Account to Account Transfers

Easily move money between your F&M Bank accounts and your accounts at other banks.

Account to Account Transfers, or A2A Transfers, is a transfer of funds between your account with one financial institution and your account at another financial institution.

- Automate your savings with recurring transfers

- Securely transfer funds between business and personal accounts

- Send funds to your college student

How does it work?

F&M Bank’s online and mobile platform allows you to enroll external accounts with ease. Newly enrolled accounts will need to be verified before they can be used to transfer funds.

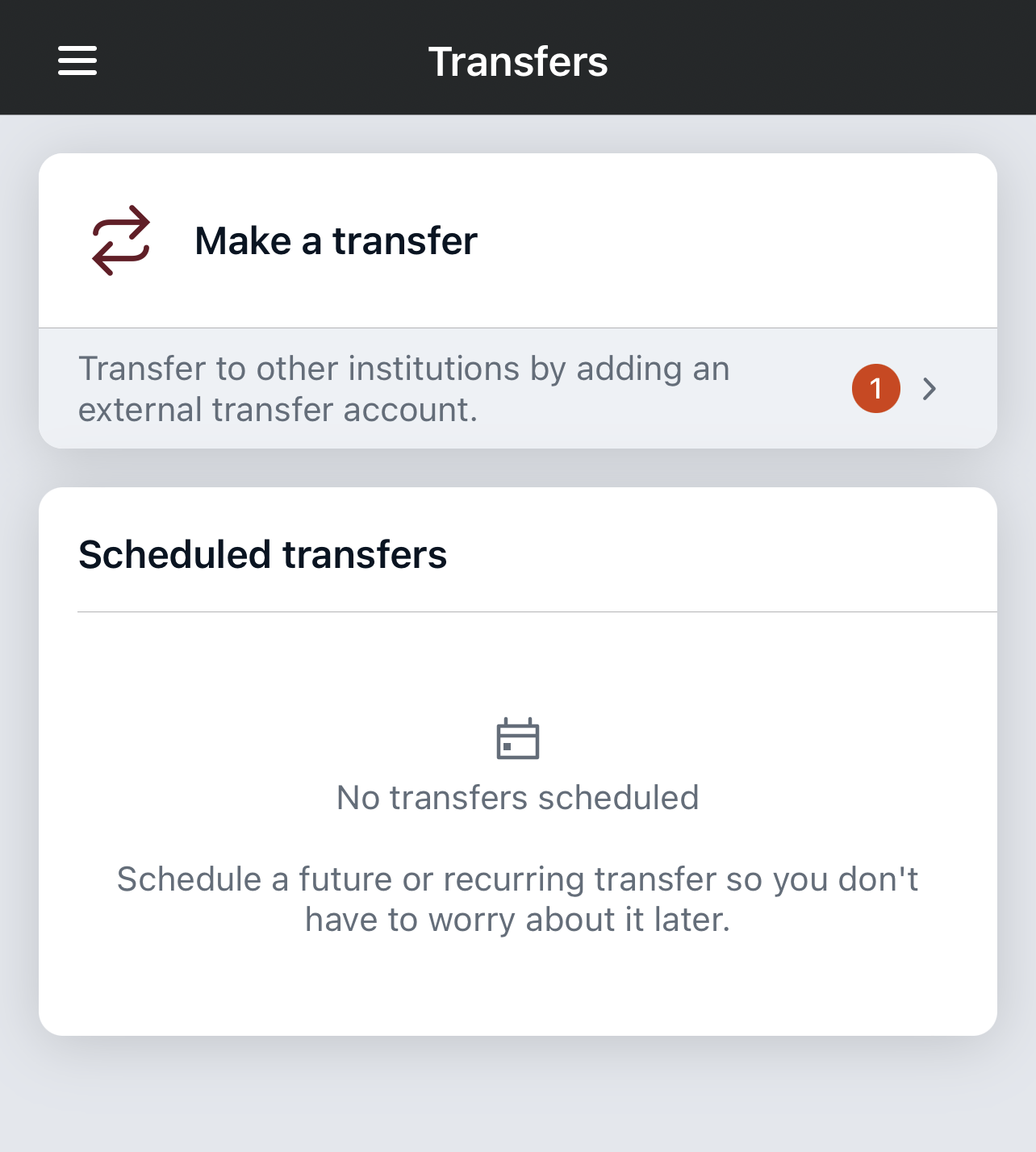

- Select Transfers from the main menu, or dashboard on F&M Mobile.

- Select +External account from the Transfers screen.

- Choose a situation and follow the corresponding steps.

- Your institution uses multifactor security questions (MFA) to authenticate users. When prompted for the security question, answer it and select Submit. OR

- Your institution uses two-factor authentication. When prompted for your password, enter it and select Submit.

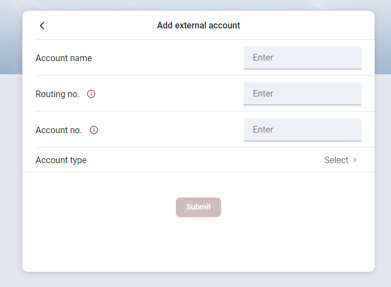

- Complete the Account name, Routing no., Account no., and Account type fields on the Add external account screen.

- Select Submit.

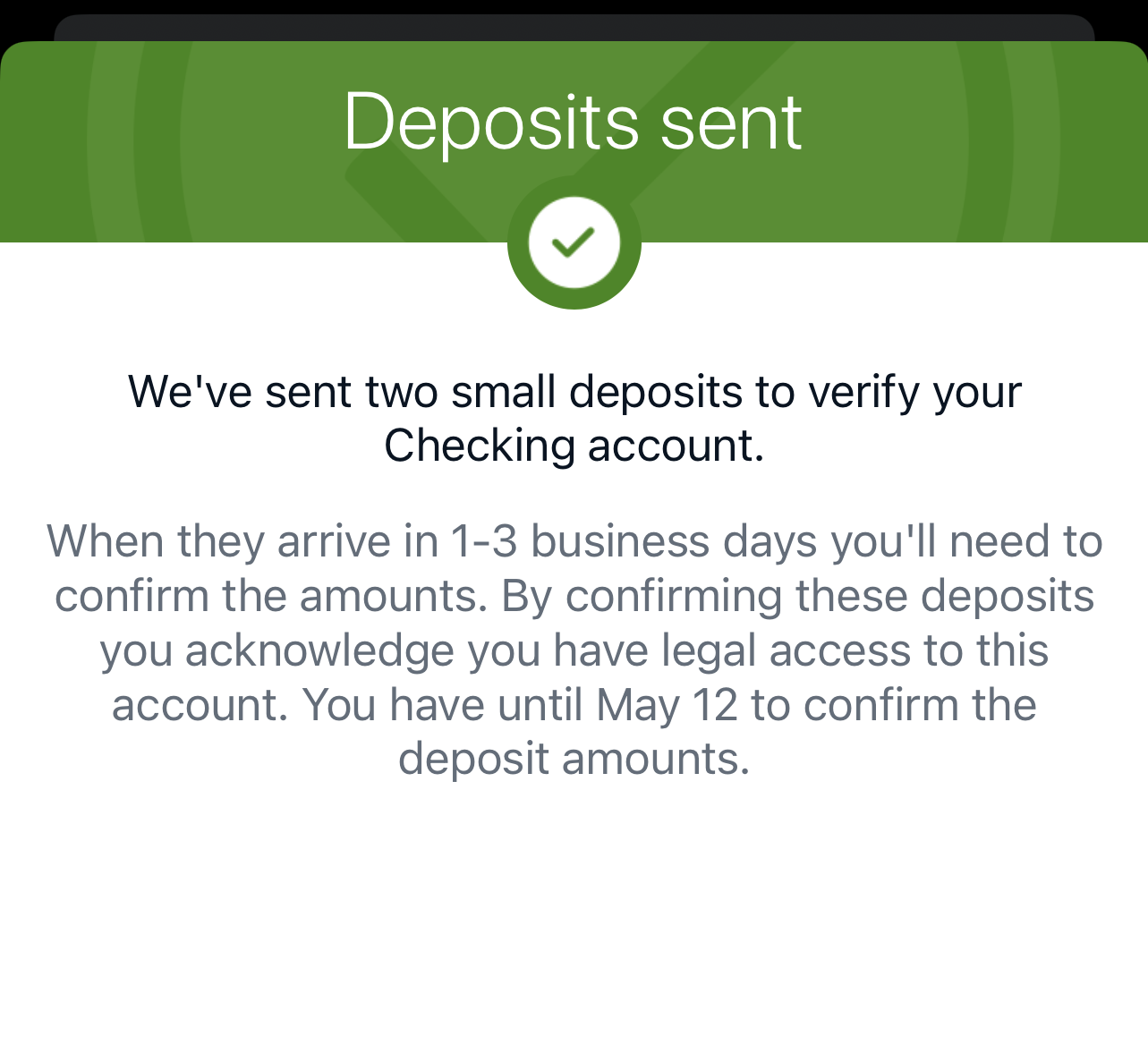

- If the account is eligible to send inbound transfers to accounts in Banno Online, a message appears saying that two small deposits have been sent to the account and will arrive in 3-5 days.

- Select OK.

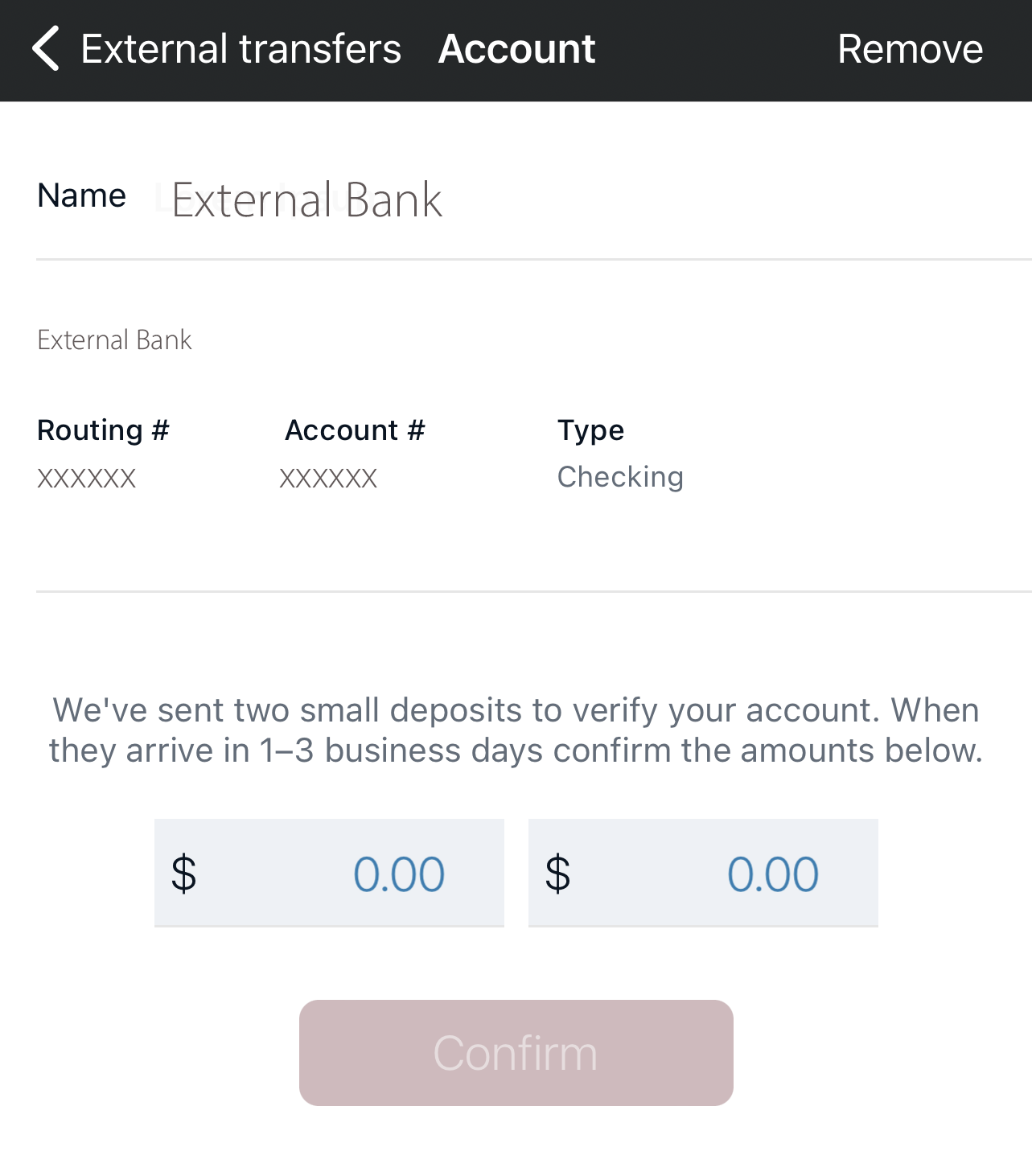

- Verify your deposit amounts after they appear in your external account(s) to activate external transfers.

- If the account is eligible to send inbound transfers to accounts in Banno Online, a message appears saying that two small deposits have been sent to the account and will arrive in 3-5 days.

Account to Account Transfer FAQs

- How much does it cost?

- Inbound transfers (money coming into your F&M Bank account) are free.

- Outbound transfers (money leaving your F&M Bank account) will incur a $1.00 charge per transfer.

- How much money can I transfer?

- Customers can transfer up to $6,000 into their F&M Bank account(s) per day.

- Outbound transfers are limited to $2,000 per day.

- When can I make transfers?

- The external transfer cutoff time is 3:00 PM. Any transfers submitted after 3:00 PM will be processed on the next business day.

- How much will the verification amounts be?

- These micro-deposits will range from $0.01 to $0.99.

- Clients will have 3 attempts to verify these amounts before needing to begin the process.

- Micro-deposits not verified within 31 days will no longer be eligible for verification and the customer will need to restart the process.

- These micro-deposits will range from $0.01 to $0.99.

- How is this different from Zelle?

- Zelle is a great platform for sending quick payments to another individual. Account to Account Transfer allows you to send funds between account you own at different financial institutions.