6 Key Metrics For Your Small Business

Running a small business can be challenging. Knowing what metrics to track can help you get on the right path and stay there. In this article, we’ll explain the most important metrics you can measure for your small business in Virginia.

Track Sales Revenue

Knowing how much money you’re bringing in is vital for any business. Revenue, also known as top-line income, means the amount of money your business makes before deducting expenses.

Tracking your sales revenue on a month-over-month basis can help you measure your business’s success and ROI on marketing campaigns. It will also alert you to signs that your sales have started declining.

How to track sales

- Define the steps involved in your sales process. What needs to happen before a deal gets closed?

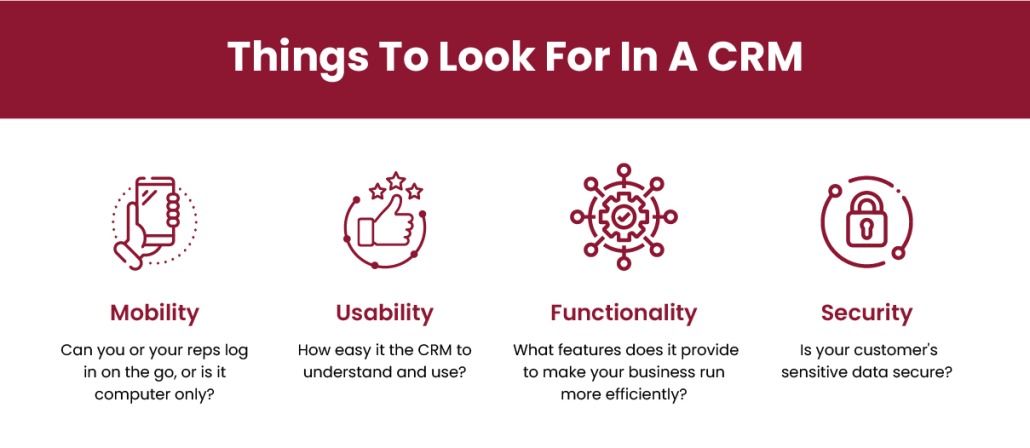

- Use a CRM (Customer Relationship Manager) to keep track of leads and where they are in the sales funnel.

- Prioritize a quick response to online form submissions.

- Based on the data you collect from tracking your sales, look for ways to increase the number of sales you make.

Customer Acquisition Cost (CAC)

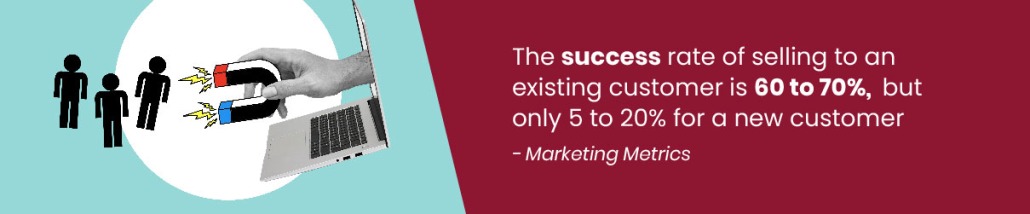

Of course, increasing sales doesn’t come without costs. That’s why our next metric looks at the cost of acquiring each new customer. This includes sales and marketing efforts, as well as physical assets (property, equipment, etc.) required to close a sale.

To calculate Customer Acquisition Cost, divide Total Marketing Costs (MCC) by Total Customers Acquired. This will give you the estimated cost of each customer acquired.

You can compare the cost per customer to the lifetime value of customers. A good rule of thumb is to spend no more than 33% of lifetime value on customer acquisition.

If you find you’re spending too much on acquiring a new customer who gives your business limited lifetime value, you can try reducing your marketing spend and focus on customer retention and upsells instead. Make sure you’re giving customers a reason to return to your business again and again.

Net Profit Margin

Net profit margin, also known as net margin, measures the percentage of sales revenue that becomes profit. This is an important indicator of your business’s financial health. Calculating net profit margin will help you evaluate the success of your marketing and sales efforts and forecast future profits based on sales revenue.

To calculate net profit margin, subtract the costs of doing business (cost of goods sold, operating expenses, interest, and taxes) from revenue and then divide that number by revenue, multiplying by 100 to convert the answer into a percentage.

When it comes to net profit margin, 10% is considered good and 20% is high. If your margin is lower than 10%, look for ways to improve it. In general, this requires you to find the right balance between increasing sales (which takes a certain amount of investment) and reducing expenses (which can lead to bad outcomes if taken too far).

Customer Retention Rate

This metric tracks the percentage of customers who buy from you more than once within a given time period. Customer retention is an important metric to track because gaining new customers is more expensive than retaining existing ones. And the more engaged your customers are, the more likely they are to try new products or services and keep spending more money on your business. This is why just a 5% increase in customer retention can increase profit by 25% or more.

To calculate your customer retention rate, (((CE-CN)/CS)) X 100.

- CE = number of customers at the end of a defined time period, such as 1 year

- CN = number of new customers acquired during the same time period

- CS = number of clients at the start of the time period

If you want to improve customer loyalty, work on providing better customer service and offering the highest quality products or services.

Gross Profit Margin

Gross profit margin is related to your gross profit, but it looks at your financial profit as a percentage. Tracking your gross profit margin will help you truly understand how your business is performing. If your gross profit margin continues to climb over time, it’s a good indicator of financial health. The higher your gross profit margin, the more you are keeping from each sales dollar (as opposed to the costs of doing business).

You can calculate gross profit margin by subtracting the cost of goods sold from net sales and then dividing that number by net sales.

If you want to increase your gross profit margin, look for ways to reduce operating expenses while maintaining pricing or increase prices without also increasing the cost of doing business. Where can you add efficiencies or boost productivity?

Customer Conversion Rates

This metric looks at the number of leads or prospects who turn into paying customers. Customer conversion rate can help you assess your sales team’s performance or the quality of the service or product you offer.

To calculate customer conversions, divide monthly new leads by monthly new customers.

With a low or stagnant conversion rate, there are some variables you can look at:

- Products or services offered

- Sales staff

- Website experience

- Social Media prescence

- Customer reviews

About Section

Headquartered in the Shenandoah Valley, F&M Bank is proud to be a Virginia tradition since 1908. We are committed to the success of our small business customers, including agricultural operations, nonprofits, and other business ventures. Learn more about our business banking solutions and contact us to learn more about how we can help your company grow and thrive.